How seniors can save on car insurance: A Comprehensive Guide

Car insurance costs can be a significant concern for seniors, especially those on fixed incomes. However, many insurance companies offer special discounts and programs specifically designed for older drivers. Understanding the available options and implementing smart strategies can help seniors substantially reduce their car insurance premiums while maintaining adequate coverage. This comprehensive guide explores practical ways for seniors to save money on car insurance without compromising on essential protection for their vehicles and financial security.

Understanding Different Types of Car Insurance Coverage

Before exploring savings opportunities, seniors should understand the various types of car insurance coverage available. Liability coverage, which includes bodily injury and property damage protection, is mandatory in most states and covers damages you cause to others. Collision coverage pays for repairs to your vehicle after an accident, while comprehensive coverage protects against theft, vandalism, and natural disasters. Personal injury protection and uninsured motorist coverage provide additional safety nets. For seniors with older vehicles, dropping collision and comprehensive coverage might make financial sense if the car’s value is low. However, those with newer or financed vehicles should maintain full coverage to protect their investment.

Strategies for Saving Money on Car Insurance Premiums

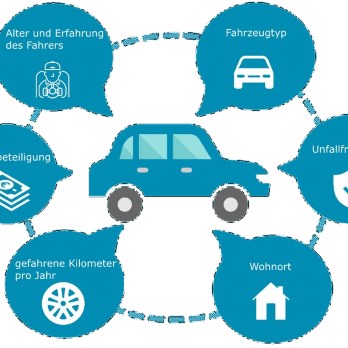

Several proven strategies can help seniors reduce their car insurance costs significantly. Many insurers offer mature driver discounts for seniors, typically starting at age 50 or 55. Completing a defensive driving course can unlock additional savings of 5-10% on premiums. Low-mileage discounts are particularly valuable for retired seniors who drive less frequently than working adults. Installing safety features like anti-theft devices, backup cameras, or automatic emergency braking systems can also qualify for discounts. Bundling car insurance with homeowners or renters insurance often provides substantial savings. Additionally, maintaining a clean driving record, improving credit scores, and paying premiums annually instead of monthly can further reduce costs.

Important Factors to Consider When Choosing Insurance Providers

When selecting car insurance, seniors should evaluate several crucial factors beyond just price. Financial stability ratings from agencies like A.M. Best indicate an insurer’s ability to pay claims. Customer service quality, including 24/7 claim reporting and local agent availability, becomes increasingly important for seniors who may need assistance. Coverage limits should align with personal assets to provide adequate protection. Deductible amounts affect both premiums and out-of-pocket costs during claims. Some insurers specialize in serving seniors and offer tailored services like accident forgiveness programs or diminishing deductibles for safe driving. Reading customer reviews and checking complaint ratios with state insurance departments helps identify reliable insurers.

Car Insurance Trends and Options for 2025

The car insurance landscape continues evolving in 2025, with new technologies and programs benefiting senior drivers. Usage-based insurance programs that monitor driving habits through smartphone apps or telematics devices offer personalized discounts for safe driving behaviors. Many insurers now provide digital tools for policy management, claims filing, and virtual vehicle inspections, though traditional phone and in-person service options remain available for seniors who prefer them. Electric vehicle discounts are becoming more common as seniors increasingly adopt eco-friendly transportation. Additionally, some companies are expanding their mature driver programs and offering new benefits like ride-sharing coverage for seniors who occasionally use services like Uber or Lyft.

| Insurance Provider | Average Annual Premium for Seniors | Key Senior Benefits |

|---|---|---|

| GEICO | $1,200 - $1,800 | Mature driver discount, defensive driving course credit |

| State Farm | $1,300 - $1,900 | Steer Clear program, good student discounts for grandchildren |

| Progressive | $1,100 - $1,700 | Snapshot usage-based program, multi-policy discounts |

| Allstate | $1,400 - $2,000 | Safe driving bonus, accident forgiveness |

| USAA (Military families) | $1,000 - $1,500 | Extended family eligibility, exceptional customer service |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Seniors can achieve significant savings on car insurance by combining multiple strategies and taking advantage of age-specific discounts. The key lies in regularly reviewing coverage needs, comparing quotes from multiple providers, and maintaining safe driving habits. As insurance companies increasingly compete for the growing senior market, more specialized programs and discounts are becoming available. By staying informed about these opportunities and working with knowledgeable agents or using online comparison tools, seniors can find affordable coverage that meets their specific needs and budget constraints while ensuring adequate protection on the road.