Comprehensive Guide for Choosing the Right Car Insurance

Selecting appropriate car insurance requires careful consideration of multiple factors that directly impact your financial protection and legal compliance. With countless policies available across various providers, understanding the fundamental elements of coverage types, personal requirements, provider differences, and cost structures becomes essential for making an informed decision. This comprehensive guide addresses the key considerations that influence your insurance selection process, helping you navigate through complex policy terms and coverage options to find protection that aligns with your specific circumstances and budget constraints.

Understanding Coverage Types

Car insurance policies typically include several distinct coverage types, each serving specific protection purposes. Liability coverage represents the foundation of most policies, covering damages you cause to other vehicles, property, or individuals in an accident. This mandatory coverage in most jurisdictions splits into bodily injury liability and property damage liability components.

Collision coverage protects your vehicle against damages from accidents with other vehicles or objects, regardless of fault determination. Comprehensive coverage addresses non-collision incidents such as theft, vandalism, weather damage, or animal strikes. Personal injury protection covers medical expenses for you and passengers, while uninsured motorist coverage protects against drivers lacking adequate insurance. Gap insurance bridges the difference between your vehicle’s actual cash value and outstanding loan balance, particularly valuable for newer vehicles.

Evaluating Your Needs

Personal circumstances significantly influence appropriate coverage levels and policy features. Vehicle age, value, and financing status directly impact coverage requirements, as newer or financed vehicles typically necessitate comprehensive and collision coverage. Your driving frequency, commute distance, and typical routes affect risk exposure and premium calculations.

Financial considerations include your ability to pay deductibles and potential out-of-pocket expenses during claims. Higher deductibles reduce premiums but increase immediate costs during incidents. Your risk tolerance and emergency fund availability should guide these decisions. Additionally, state minimum requirements establish baseline coverage levels, though these minimums often provide insufficient protection for significant accidents.

Family circumstances, including teenage drivers or multiple vehicles, create additional considerations for policy structure and coverage limits. Professional driving requirements or vehicle usage for business purposes may necessitate specialized coverage beyond standard personal policies.

Comparing Insurance Providers

Insurance providers differ significantly in coverage options, pricing structures, customer service quality, and claims handling processes. Financial stability ratings from agencies like AM Best, Moody’s, or Standard & Poor’s indicate a company’s ability to pay claims consistently. These ratings range from superior to poor, with higher ratings suggesting greater reliability during claim situations.

Customer satisfaction surveys and complaint ratios provide insights into service quality and claims experiences. State insurance departments maintain complaint databases comparing providers within specific regions. Digital tools, mobile applications, and online account management capabilities vary considerably among providers, affecting convenience and accessibility.

Claims processing efficiency and customer support availability during emergencies represent critical factors often overlooked during initial policy selection. Some providers offer 24/7 claim reporting and roadside assistance, while others maintain limited service hours. Regional presence and local agent availability may influence service quality and personalized support options.

| Provider | Annual Premium Range | Coverage Options | Key Features |

|---|---|---|---|

| State Farm | $1,200 - $2,400 | Full range including specialty coverage | Local agent network, comprehensive mobile app |

| GEICO | $900 - $2,100 | Standard coverage with digital focus | Online discounts, 24/7 customer service |

| Progressive | $1,000 - $2,200 | Usage-based and standard policies | Snapshot program, comparison shopping tools |

| Allstate | $1,300 - $2,500 | Traditional and innovative coverage | Drivewise program, accident forgiveness |

| Liberty Mutual | $1,100 - $2,300 | Customizable coverage packages | Multiple discount programs, new car replacement |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Understanding Premiums and Discounts

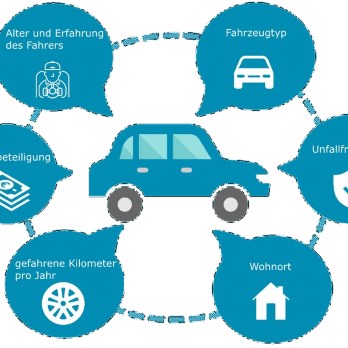

Premium calculations incorporate numerous factors including driving record, age, location, vehicle type, credit score, and coverage selections. Insurance companies use complex algorithms weighing these variables differently, resulting in significant price variations for identical coverage across providers.

Discount opportunities can substantially reduce premium costs through various qualifying criteria. Multi-policy discounts reward customers bundling auto insurance with home, renters, or other insurance products. Safe driving discounts recognize clean driving records, while defensive driving course completion may provide additional reductions.

Vehicle safety features including anti-theft systems, airbags, and anti-lock brakes often generate discounts. Low mileage discounts benefit infrequent drivers, while good student discounts apply to young drivers maintaining academic achievements. Military service, professional affiliations, and alumni memberships may qualify for group discounts through specific providers.

Usage-based insurance programs monitor driving behaviors through telematics devices or mobile applications, potentially offering significant savings for safe drivers. These programs typically track factors including acceleration patterns, braking habits, speed, and driving times to calculate personalized premium adjustments.

Selecting appropriate car insurance requires balancing coverage adequacy with affordability while considering your specific circumstances and risk factors. Thorough research comparing multiple providers, understanding coverage implications, and regularly reviewing policy terms ensures your protection remains aligned with changing needs. Taking time to evaluate options comprehensively ultimately provides better financial protection and peace of mind on the road.